Bitcoin, the highly controversial open source P2P cryptocurrency has been trending lately as it pushes closer towards the US $50,000 mark. This was spurred further by news of Elon Musk’s Tesla investing US $1.5 billion into Bitcoin. The company also announced that it is going to start accepting bitcoin as payment for its products soon. While this is likely the largest bitcoin purchase by a public company, it is certainly not the only institutional investment into cryptocurrency. While the likes of Square and MicroStrategy have already invested directly into bitcoin, financial behemoths such as Visa, PayPal and Fidelity have put their support behind the cryptocurrency. It is also noteworthy that Uber is considering Bitcoin and other cryptocurrencies as a form of payment from customers.

Bitcoin, the highly controversial open source P2P cryptocurrency has been trending lately as it pushes closer towards the US $50,000 mark. This was spurred further by news of Elon Musk’s Tesla investing US $1.5 billion into Bitcoin. The company also announced that it is going to start accepting bitcoin as payment for its products soon. While this is likely the largest bitcoin purchase by a public company, it is certainly not the only institutional investment into cryptocurrency. While the likes of Square and MicroStrategy have already invested directly into bitcoin, financial behemoths such as Visa, PayPal and Fidelity have put their support behind the cryptocurrency. It is also noteworthy that Uber is considering Bitcoin and other cryptocurrencies as a form of payment from customers.

Blog

Indian Aquaculture: Poised for a Quantum Leap

This article was published in the Sunday Pioneer of The Pioneer newspaper: https://bit.ly/2YAE5UV

The times have never been better than what’s happening now for the fisheries, seafood processing and aquaculture sector in India.

It’s just less than an year after the Hon’ble Finance Minister, Smt Nirmala Sitharaman, announced a financial package of Rs.20,000 Crore under the Pradhan Mantri Matsya Sampada Yojana (PMMSY), to help address the ‘critical gaps in the fisheries value chain’ and for the ‘integrated, sustainable, inclusive development of the marine and inland fisheries and aquaculture sector’, both, development initiatives of wide impact and significance.

Of the total allotment, the Minister explained that Rs.11,000 Crore will be exclusively for activities in the marine, inland fisheries and aquaculture and Rs 9000 Crore for the development of infrastructure of fishing harbours, cold chain and markets, etc.

What was strikingly different about this relief measure was that, the funds set aside for aquaculture industry were estimated based on the sector’s long-standing needs: new technology and research-based production, higher quality breeding stock, modernisation of the infrastructure and related development aspects.

Finally, someone did stop to hear the painful cries that arose deep from the hearts of the thousands of marine and inland aquaculture farmers, investors and their large workforce of hardworking labourers, who were together seeking and praying for a listening ear of the powers-that-be at the Centre, for quite some time in the recent past.

Not surprisingly, the measures were received as a big relief by the stakeholders who were struggling to survive after the devastating effect of Novel Corona virus pandemic which had ravaged the country for nearly the whole of 2019, with unemployment and financial recession of no small dimension.

The special PMMSY funds flow has since been hailed as a major boost for the industry which is now fast-gearing up for a quantum leap into capacity expansion,

diversified growth and for creating a larger footprint in the export markets of the world with its range of processed sea foods and freshwater aquaculture specialities.

As an indicator of the importance that the Government is extending to this sector, the Hon’ble Finance Minister has also announced in her speech of the he formation of a separate ‘Ministry of Fisheries, Animal Husbandry and Dairying’, headed by a Minister of Cabinet rank, and backed by a special budget of Rs. 3737 Cr for its formation.

With this Ministry in operation, under the able leadership of Sri Giriraj Singh, there’s a huge potential for growth coming in the fisheries and allied industries and the Government’s target of ‘doubling the farmer’s income by 2022 would move closer to reality, given favourable circumstances to follow.

As one leading management expert on industry pointed out, “bringing allied sector such as fisheries in focus can help the development of fishing communities and fisheries as an occupation.”.

Indeed, it’s not business as usual that’s happening, here.

Quite truly, the flagship development model of the Modi Government, named as the ‘Atmanirbhar Bharat Abhiyan (self-reliant campaign), is acting as powerful catalyst to the country’s Blue Revolution, which continues to be a national agenda.

Great Potential

India ranks second in the world in fish production with a capacity of about 9.6 million tonnes per annum. This amounts to over 10% of the global fish diversity, and much of it is credited to the inland fisheries and aquaculture infrastructure in the country.

With an employment base of 145 million individuals the fisheries industry contributes to 1.07% of the nation’s GDP, generating an equivalent of Rs.334.41 billion in export earnings.

It is estimated that the present production capacity in the industry of 9.6 million metric tonnes per annum (as of FY20) would attract a quantum leap over the next

two years to meet the estimated demand of nearly 11.80 million metric tonnes by FY21.

Of the total fish production in India, the share of freshwater aquaculture is at 55% and the major contributor to this segment is the smallholder inland fish farmers and supported by the culture fisheries institutions.

The announcements made by the Hin’able Minister for Fisheries and Animal husbandry highlights the Centre’s recognition of the several concerns faced by the industry, especially over the multiple challenges of the bio-diversities and geographical conditions that affect the industry.

It is estimated that only 10 to 15 percent of Indian freshwater fish have been brought under feed-based farming, and a great majority of freshwater aquaculture still has scope for converting to this system, which if properly addressed will contribute more to resource savings and at the same time increase fish production in the country.

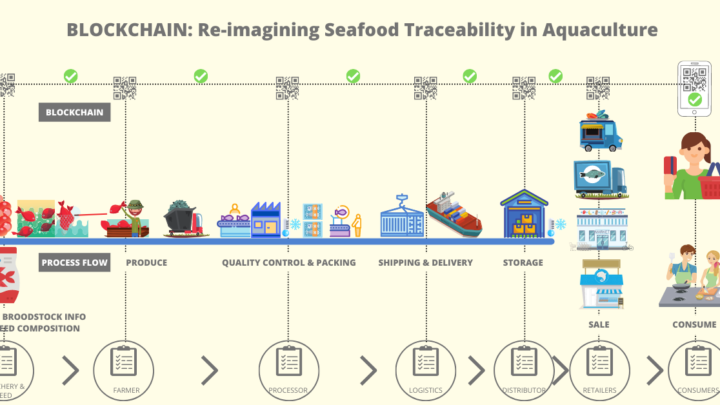

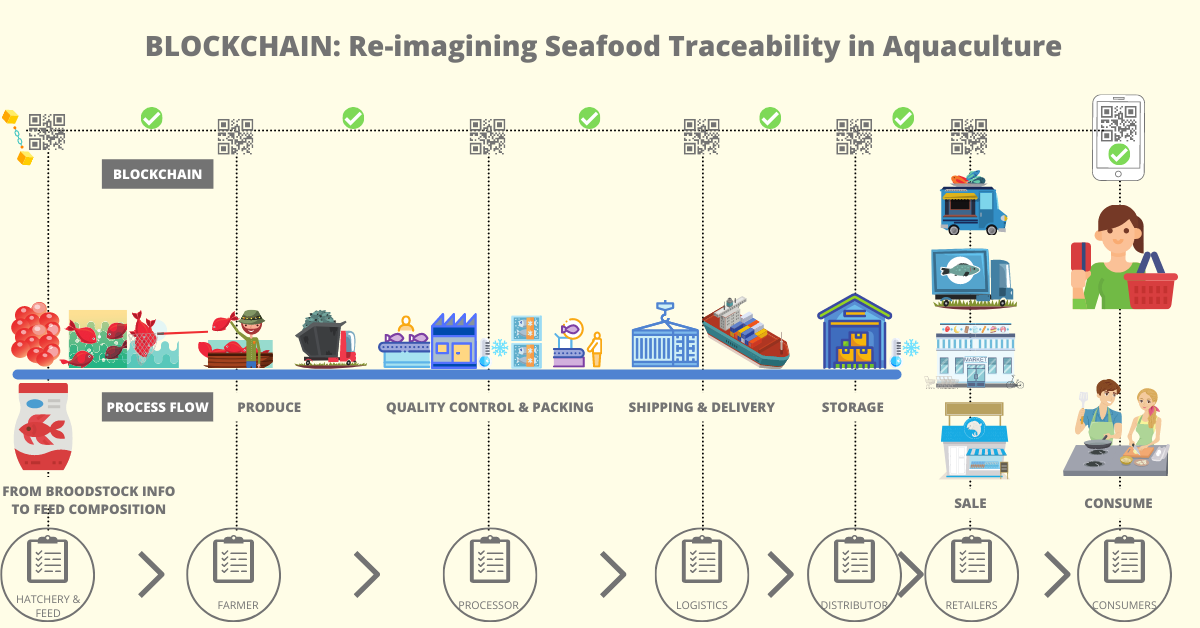

Modernisation also means adequate improvements in the cold chain and distribution system in the country and this has been recognised as a priority area for investment, and attracted new budget allocation.

Great Relief

Given the reasonable time for the relief package to trickle down to the grass roots, or below the water levels, shall we say, would mean an enhanced production of 70 lakh metric tonnes of farm-fresh fish well within the next 5

Years, by any reasonable estimate.

The expansion in fisheries industry would attract direct and indirect employment in the region of 55 lakh job opportunities whilst the export potential would touch Rs.1.0 lakh Cr by the end of the coming half decade, say industry analysts.

Rising Growth Curve

There is no reason to disbelieve or doubt that our seafood and freshwater fish farm industry can only usher-in revolutionary transformations in growth and content performance in the coming decade taking into consideration the gigantic improvements which the country has already achieved in the fields of infrastructure, technology, quality of manpower and with the opening up of the world markets as the gateways for additional performance.

It is estimated that only about 10% of the 2.36 million hectares of available land with its water bodies suitable for aquaculture is being actually put to good fresh water aquaculture farming, matching industry standards. The land, thus offers immense potential for growth in this industry which is highly profitable, if managed well and with prudence.

Technology Next

Digital is the new frontier in the fisheries sector. Much has been discussed about the arrival of digital technology in the agro-farming industries and into fisheries development as well. Today, the time is ripe to shift gears into fast drive and move into modernisation of the farms with the hi-tech.

Smart technology-related software including Artificial Intelligence, Internet of Things and Big Data are heavily being researched upon in this sector, and as reports last came in, the day is not far off when even the small holder fish farm worker shall be equipped with infrastructure facilities and training to utilze the research benefits as an everyday way of life.

Organic Growth

The third platform for development of the sector is seen as the organic farming. This technique is also fast taking over as part of the good farming practices. So much work has already gone into this area, with awareness of climate change, pollution and effects of water-table contamination that right from the fish feeds to the maintaining the water quality and soil preservation has taken precedence in the industry.

Many progressive aquaculture projects have switched to organic feeds and farming inputs which again has opened avenues for bio-fertiliser as a by-product out of fish waste which is direct boost for ago-farms to multiply their organic vegetables and crop production. A value-addition input in the agro sector under GAP.

Quite truly, the flagship development model of the Modi Government, named as the ‘Atmanirbhar Bharat Abhiyan (self-reliant campaign), is acting as powerful catalyst to the country’s Blue Revolution, which continues to be a national agenda.

IMF projects 11.5% Growth

Just in: The International Monetary Fund (IMF) has projected an impressive 11.5 per cent growth rate for India in 2021, making the country the only major economy of the world to register a double-digit growth this year amidst the corona virus pandemic.

While this projection is for the entire economy of the country, it is safe to assume that the marine and freshwater aquaculture sector shall also receive a reasonable buoyancy with the rising of the overall verticals.

With the latest projections, India regains the tag of the fastest developing economies of the world. ‘What we see is that transition, combined with policy support, seems to have worked well.’, according to the IMF Chief who has assessed that India is ‘almost where we were before Covid… meaning that economic activities have been revitalized quite significantly,’.

With all this and more happening, the starry-eyed hopefuls of the seafood and the inland aquaculture domain are watching and waiting – for, it’s curtain-raiser time to begin a whole new colourful performance in production capacities and financial revival – à la the fishing industry! Aquaculture industry today is at the same growth stage where IT industry was 20 years back. The industry is waiting with bated breath for the new budget where a slew of measures are expected to give further momentum to the growth to fulfill its true potential. As a sign-off, the much-favoured slogan of the entertainment world comes to memory:

‘Let the show begin’!

The writer is the Chairman and Managing Director of Kings Infra Ventures Ltd., Kerala, India.

Links:

Pioneer Edge article: https://bit.ly/2YAE5UV

Download the Sunday Pioneer newspaper: https://bit.ly/36uUhvf